Farm equipment depreciation calculator

Using an hourly rate to calculate depreciate now allows the manager to. Under this method each item whether raised or purchased is valued at its market price less the direct cost of disposition.

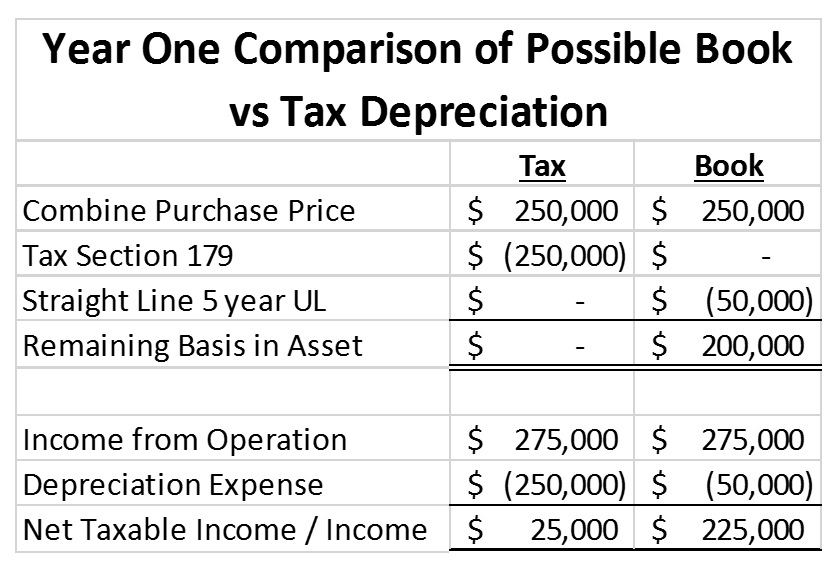

2018 Tax Reform What It Means For Agriculture

A calculator to quickly and easily determine the appreciation or depreciation of an asset.

. Use the Below Calculator to Check Your Tax Write Off. California has very specific rules pertaining to depreciation and limits any Section 179 to 25000 Maximum per year. 1500 300 3 years 400year.

As an example of depreciation calculations consider a 130 horsepower hp two-wheel-drive tractor with a list price of 120000. The MACRS Depreciation Calculator uses the following basic formula. D i C R i Where Di is the depreciation in year i C is the original purchase price or basis of an asset Ri is the depreciation.

To test it out. The total section 179 deduction and depreciation you can deduct for a passenger automobile including a truck or van you use in your business and. Depreciation limits on business vehicles.

Depreciation rate 1 useful life If an asset with a useful life of five years and a salvage. The Section 179 Tax Deduction encourages agri businesses to stay competitive by purchasing shortline equipment which. At that point you think you can get 300 for it at resale.

Our Premium Calculator Includes. Using straight-line depreciation your depreciation cost would be 400 per year. Market price is the current price at the nearest.

With dealer discounts the purchase cost was 115000. So for example if you purchase a business van that. If the tractor costs 135000 the hourly depreciation over its useful life would be 9 per hour 13500015000.

- Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and. Our Premium Calculator Includes. - Compare Cities cost of living across 9 different categories - Personal salary calculations can optionally include Home ownership or rental Child care and.

A Small Farm May Be An Ongoing Family Venture Or A New But Growing Business That Will Eventually Become A Full Time Sou Grow Business Tax Write Offs Small Farm

Depreciating Farm Property With A 10 Year Recovery Period Center For Agricultural Law And Taxation

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Computing Machinery Ownership Costs Farmdoc Daily

Depreciation What It Is And How To Use It Cropwatch University Of Nebraska Lincoln

Depreciation And Farm Machinery A Rule Of Thumb Grainews

Methods Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Pin On Agricultural Machinery

Depreciating Farm Property With A 20 Year Recovery Period Center For Agricultural Law And Taxation

The Silver Lining To Used Equipment Prices Farming Organic Farm Farmers Farmersmarket Agriculture Ou Successful Farming American Agriculture Agriculture

Macrs Depreciation Calculator With Formula Nerd Counter

The Impact Of Power And Equipment Costs On Illinois Grain Farms Farmdoc Daily

Revaluation Method Of Calculating Depreciation Accounting Simpler Enjoy It Method Calculator Accounting

Income Tax Considerations When Transferring Depreciable Farm Assets Ag Decision Maker

Accelerated Depreciation And Machinery Purchases Farmdoc Daily

Depreciation Formula Calculate Depreciation Expense